FBAR (Foreign Bank Account Reporting)

- Sharon Choi, CPA

- Dec 15, 2023

- 3 min read

Purpose of the FBAR

U.S. persons maintain overseas financial accounts for a variety of legitimate

reasons including convenience and access. Foreign financial institutions may

not be subject to the same reporting requirements as domestic financial insti-

tutions. The FBAR is used by the U.S. government to identify persons who may

be using foreign financial accounts to circumvent U.S. law. FBAR information

can help identify or trace funds used for illicit purposes or identify unreported

income maintained or generated abroad.

Who Must File the FBAR?

A U.S. person must file an FBAR if they have a financial interest in or signa-

ture or other authority over any financial account(s) outside the U.S. and the

aggregate amount(s) in the account(s) exceeds $10,000 at any time during

the calendar year.

Who is a U.S. Person?

A “U.S. person” means:

• A citizen or resident of the United States;

• An entity created, organized, or formed in the United States or under the

laws of the United States, any State, the District of Columbia, the Territories

and Insular Possessions of the United States, or the Indian Tribes. An

“entity” includes but is not limited to, a corporation, partnership, trust, and

limited liability company; or

• An estate formed under the laws of the United States.

Disregarded Entities: U.S. persons that are disregarded entities for tax purposes

may need to file an FBAR. The federal tax treatment of an entity doesn’t affect

the entity’s requirement to file an FBAR. FBARs are required under a Bank

Secrecy Act provision of Title 31, not under any provision of Title 26 (Internal

Revenue Code).

• U.S. Resident: To determine if a person is a resident of the United States, apply

the residency tests in Section 7701(b)(1)(A)(i)-(iii) of Title 26 of the United States

Code (USC). When applying the residency tests, the United States includes

the States, the District of Columbia, all U.S. territories and possessions (i.e.

American Samoa, the Commonwealth of the Northern Mariana Islands, the

Commonwealth of Puerto Rico, Guam, and the U.S. Virgin Islands), and the

Indian lands defined in the Indian Gaming Regulatory Act.

Example: Chulsoo is a citizen of South Korea. He has been physically present in the U.S.

every day of the last three years. Because Matt is considered a resident under 26

USC Section 7701(b), he is a U.S. person for FBAR purposes.

Example: Soonhee is a permanent legal resident of the U.S. Soonhee is a citizen of the South Korea. Under a tax treaty, Soonhee is a tax resident of the South Korea and elects

to be taxed as a resident of the South Korea. BUT Soonhee is a U.S. person for FBAR

purposes. Tax treaties with the U.S. do not affect FBAR filing obligations.

Financial Account

Financial accounts include:

• Bank accounts such as savings and checking accounts, and time deposits,

• Securities accounts, such as brokerage accounts, securities derivatives

accounts, or other financial instruments accounts;

• Commodity futures or options accounts;

• Insurance or annuity policies with a cash value (such as a whole life

insurance policy);

• Mutual funds or similar pooled funds (i.e. a fund available to the public with

a regular net asset value determination and regular redemptions), and;

• Any other accounts maintained in a foreign financial institution or with a

person performing the services of a financial institution.

Example: Canadian Registered Retirement Savings Plan (RRSP), Canadian Tax-Free

Savings Account (TFSA), Mexican individual retirement accounts (Fondos para el

Retiro) and Mexican Administradoras de Fondos para el Retiro (AFORE) are foreign

financial accounts reportable on the FBAR.

Example: Foreign hedge funds and private equity funds are not reportable on the

FBAR.

Example: A foreign account holding virtual currency is not reportable on the FBAR

(unless it’s a reportable account under 31 C.F.R. 1010.350 because it holds report-

able assets besides virtual currency). These funds aren’t reportable at this time, per

FBAR regulations issued by FinCEN February 24, 2011, but FinCEN Notice 2020-2

indicates FinCEN’s intention to propose amending the regulations to include virtual

currency as a type of reportable account under 31 CFR 1010.350

Penalties for not filing FBAR

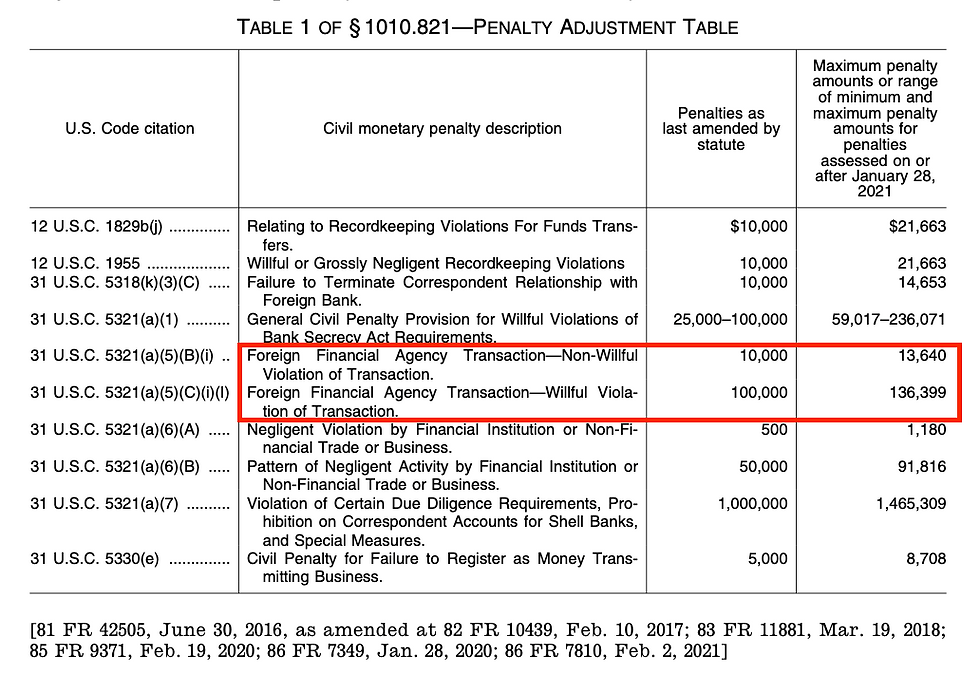

Up to $136,399 and 10 years in prison. See below for the Pently Adjustment Table on the U.S. Government website that dictates financial penalties, inflation and adjustments, and also the link explaining the penalties by IRS.

Comments